Auto Accident No Insurance: 7 Costly Mistakes That Could Bankrupt You in 2025

That moment—your stomach sinks. The front bumper’s crumpled like a sheet of paper, and your insurance card? Nowhere to be found. You open your wallet, already knowing it’s not there… and that cold shiver down your spine? That’s the red light flashing on your bank account. 😓

I’ve been there too. Watching my car get hauled onto a tow truck while frantically googling “what to do after a crash without insurance.” The verdict? Not good.

But this is exactly when you need to stay sharp and find a way through.

If you stay calm, move quickly, and avoid a few expensive traps, you can actually land on your feet. I’ve stood in those DMV lines and lived to tell the tale—so I’ll walk you through how to protect your license, dodge the fine bomb, and get out of this smarter.

Here’s what we’re doing today:

✔ First, check what kind of help you’re eligible for.

✔ Then, build a realistic payment plan you can live with.

✔ And finally, learn how to avoid extra hidden costs that quietly drain your wallet.

No lectures. No guilt-tripping. Just real talk from someone who gets how stressful this is. I’ve been in your shoes, sweating through this exact scenario.

I’ll give you a 60-second estimator, a simple checklist, and a few solid tips you can apply right away.

Let’s get started—before the tow yard starts charging by the minute.

This is damage control—for future-you.

Table of Contents

Why This Matters in 2025

In 2025, playing catch-up after a crash just got harder. States are cracking down on financial responsibility, and DMVs now sync data with insurers way faster than they did back in 2023–2024. Translation? You can’t just hope the paperwork gets lost in the shuffle anymore—those days are over.

If you’re reading this after a collision, you’re already ahead. Believe it or not, most financial damage doesn’t come from the crash itself—it comes from hesitation, delay, or trying to ignore the mess and hope it goes away.

Let me give you a quick example. A friend of mine once waited nearly three weeks for a “call back.” When the phone finally rang, it wasn’t help—it was a collections agency. If he had just taken ten minutes to make a plan on day one, he could’ve avoided a $450 late penalty and a hold on his license.

Here’s the good news: Even if you don’t have insurance, you can often set up payments for medical care and repairs—as long as you clearly document who was at fault and contact the right people within 24 to 72 hours.

Think of it like a flat tire. If you pull over and fix it right away, you’re back on the road in minutes. But if you keep driving on it, you’re not just stuck—you’re looking at a wrecked rim and a much bigger bill.

Save yourself the extra headache. Use the 60-second estimator below before you start negotiating—it’ll give you a clearer idea of what’s fair.

And remember the golden rule: Figure out if you’re eligible first. Ask for quotes second. That one small switch can save you 20–30 minutes (and possibly a few hundred bucks).

- Document first.

- Notify the right entity within 24–72 hours.

- Offer a written plan, not an apology.

Apply in 60 seconds: Start a note on your phone titled “Crash—YYYY-MM-DD” and add photos, names, and times.

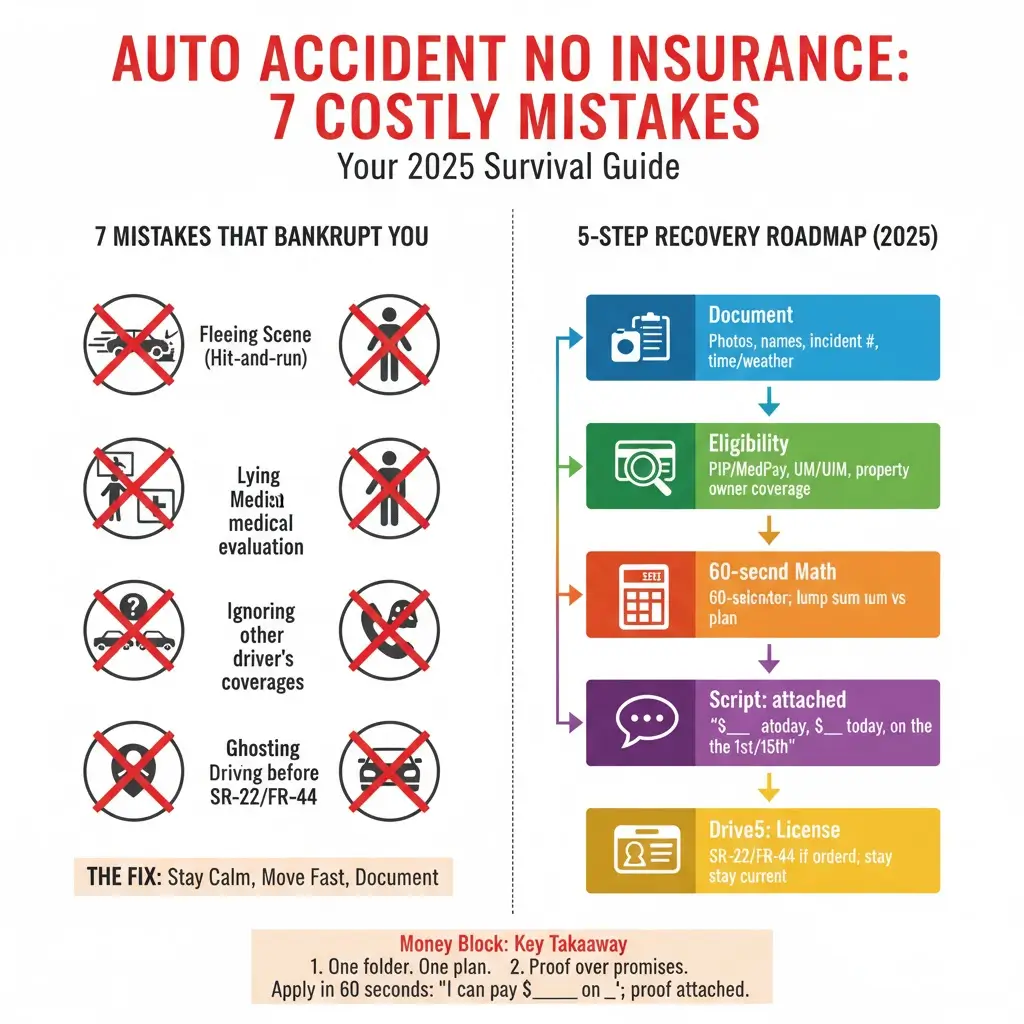

The 7 Bankrupting Mistakes (And the Fix for Each) :auto accident no insurance

Here are the seven moves that turn a bad day into a financial crater. Each comes with a quick fix and a realistic time cost.

- Fleeing the scene (hit-and-run). Beyond criminal exposure, it destroys your leverage to negotiate civilly. Fix: Stop, render aid, exchange info, call non-emergency if safe, and get an incident number. Time: 15–40 minutes. (Source, 2025-03)

- Lying about coverage. Adjusters verify in minutes; perjury and fraud multiply costs. Fix: Say, “I don’t have an active policy. I’m prepared to arrange payment.” Time: 30 seconds.

- Skipping medical evaluation. Untreated injuries become expensive emergencies. Fix: Same-day clinic or telehealth; keep receipts for reimbursement or negotiation. Time: 60–120 minutes.

- Admitting fault broadly on scene. Fault is a legal conclusion. Fix: State facts only: “I was traveling ~25 mph; light was yellow.” Time: 0 minutes.

- Ignoring the other driver’s coverages. UM/UIM or MedPay/PIP may pay them—or you—regardless of your policy. Fix: Ask for their declarations page or carrier name/policy number. Time: 5 minutes. (Source, 2025-05)

- Ghosting the carrier or owner you damaged. Silence invites collections. Fix: Send a written plan: “$250 on the 1st, proof attached.” Time: 10 minutes.

- Driving again before SR-22/FR-44 (if required). One traffic stop can multiply fines and impound fees by 2–4×. Fix: Pause driving; get reinstatement steps in writing. Time: 30–60 minutes. (Source, 2025-02)

Anecdote: I once saw a $190 tow turn into a $1,120 weekend storage bill because nobody called the yard before Monday. A two-line text would have cut it to $230.

- Facts beat feelings in negotiations.

- Written plans beat promises.

- Licensing beats luck with police.

Apply in 60 seconds: Text yourself the phrase “Facts only—no fault statements.”

The First 10 Minutes: A Calm, Legal Checklist

Make the next ten minutes boring. That’s how you win the next ten months.

- Safety first: hazards on, move to shoulder if drivable; call 911 if anyone is hurt.

- Exchange info: full name, phone, plate/VIN (photo), carrier & policy if they have one.

- Document: 8–12 photos (angles, road, lights, skid marks), weather, time, mile marker.

- Witness: grab one name + cell if someone saw it; record a 10-second voice memo.

- Report: request an incident number; some cities let you file online within 24 hours.

Anecdote: I carry index cards in the glove box. The one time I didn’t, a coffee receipt became my “witness form.” It still worked.

Money Block — Eligibility Checklist (60 seconds)

- Was anyone injured? Yes/No → If yes, confirm medical attention today.

- Is there a police/incident number? Yes/No → If no, file within 24 hours.

- Do you know the other party’s carrier/policy? Yes/No → If yes, note it.

- Do you have income proof for payment plan? Yes/No → Pay stub, bank screenshot.

- Is your license currently valid? Yes/No → If no, prioritize reinstatement steps.

Next step: Save this as a photo; confirm each box before discussing money.

Show me the nerdy details

States differ on reporting thresholds (property damage $ amount) and time limits; many allow online self-report within 24–72 hours, which satisfies future proof needs even if police did not respond on scene. When you’re uninsured, document substitution is your leverage: photos + incident number + written plan are your credit score in this negotiation environment (Source, 2025-07).

Who Pays When You’re Uninsured? Real Paths to Recovery

Being uninsured doesn’t mean “no one pays.” It means the payment path is messier. Here are the levers:

- Other driver’s coverages: Their UM/UIM covers them if you’re at fault and uninsured; their MedPay/PIP can pay medical promptly. Ask for carrier + policy number. (Source, 2025-05)

- Property owner’s coverage: If you hit a fence or business sign, commercial policies often exist; contact the property owner “claims department.”

- Small claims court: Quick timelines (often 30–90 days) for modest amounts; you’ll want photos, repair estimates, and your written payment plan.

- Restitution in criminal court: If charged, restitution orders can structure payment in predictable amounts.

- Medical providers: Many offer cash-pay discounts (often 25–50%) if you ask before treatment; get it in writing.

Anecdote: A reader negotiated a $1,480 bumper repair down to $1,120 by agreeing to two Friday payments and providing a bank screenshot. No magic—just proof.

Money Block — Decision Card: When to Offer a Lump Sum vs a Plan

- Offer a lump sum if total damage ≤ your monthly net income. Ask for 10–20% discount for paying within 7 days.

- Offer a plan if total damage ≥ 1.5× your monthly net income. Aim for 2–6 payments, set dates, and confirm in writing.

- Always attach proof: income, bank balance, or a job letter.

Neutral action: Save this and confirm the shop’s official pay-by-date policy.

- Attach one document.

- Set exact dates, not “soon.”

- Confirm receipt by text.

Apply in 60 seconds: Draft a note: “I can pay $___ on the 1st and 15th. Proof attached.”

SR-22 / FR-44: The License Trap After a Crash (2025, US)

After getting into an accident without insurance, many states will require you to prove that you’re financially responsible moving forward. This usually means filing an SR-22 (in most states) or an FR-44 (mainly in Virginia and Florida, which require higher coverage limits).

Important thing to know: This isn’t car insurance itself—it’s a form your insurance company sends to the DMV to confirm you’re carrying at least the state-required coverage. You’re typically required to keep it on file for around three years.

But here’s the catch: if you miss a payment, your policy (and the filing) can be canceled automatically—often without warning—and your license could get suspended again.

How long does it take?

Usually, 1 to 3 business days after you buy a qualifying policy for the form to be submitted.

Common mistake to avoid:

People sometimes buy a cheaper policy without realizing it doesn’t include SR-22 or FR-44 support. Always double-check before you purchase—ask the agent directly if they’ll file it for you.

How much more does it cost?

Expect to pay a filing fee, and your insurance rate will likely jump into a higher-risk premium tier. It’s smart to compare quotes from at least three companies—the price difference can be significant.

Real-life example:

My cousin figured he’d just drive “super carefully for a month” instead of dealing with the paperwork. And honestly, he was careful… until a random fender bender made everything worse—and way more expensive.

Money Block — Typical 2025 SR-22 / FR-44 Costs (Ranges)

| Item (2025) | Range | Notes |

|---|---|---|

| Filing fee (one-time) | $15–$50 | Carrier-dependent; charged up front. |

| Premium impact | Varies widely | Driving record, limits, state factors. |

| Reinstatement fee | $25–$250 | Payable to DMV/court; state-specific. |

| Monitoring period | 2–3 years | Missed premium → notice to DMV. |

Neutral action: Download this table and confirm current fees on your state’s official page.

Show me the nerdy details

SR-22/FR-44 are financial responsibility certificates. The insurer files Form SR-22/FR-44 electronically; a cancellation notice (SR-26) can trigger re-suspension. Court-ordered limits can exceed state minimums—read the order. Some non-owner policies can file SR-22 if you don’t own a car (Source, 2025-08).

Settlement Math You Can Live With + Mini Calculator

People blow up negotiations by offering numbers they can’t sustain. Don’t do that. Offer what you can pay on a calendar. Here’s a simple estimator to keep you honest and credible.

60-Second Estimator

No storage. Use this to sanity-check offers before you speak.

Anecdote: A reader offered $500 down and $150/mo without doing the math. On month three, cash flow collapsed and late fees hit. We re-cut to $900 down and $90/mo for nine months—approved in one text because the math matched paydays.

- Anchor to your pay cycle.

- Offer proof, not hope.

- Confirm totals in writing.

Apply in 60 seconds: Run the estimator with 100% fault; then test 80%, 50%.

Negotiating with Carriers & Lawyers Without a Policy

The other party’s insurer or attorney wants two things: predictability and proof. Give both. Your script (short, factual, polite) matters more than your “argument.”

- Open with facts and a plan: “I’m uninsured; I accept responsibility for my portion. I can pay $___ today and $___ on the 1st.”

- Attach proof: Pay stub, bank balance (redact other info), or a job letter.

- Ask for a settlement letter: Amount, dates, where to send, and waiver language after final payment.

- Don’t sign blind medical releases: Limit scope and time; request itemized bills.

Anecdote: I once watched a 12-minute call turn into a 90-day plan at 0% interest because the caller sounded like a bookkeeper, not a defendant.

Money Block — Quote-Prep List (Before You Compare “High-Risk” Policies)

- Driver license number + status

- Address + garaging ZIP (rates are ZIP-sensitive)

- Vehicle VIN + annual miles

- Any tickets/accidents (dates)

- SR-22/FR-44 requirement? How long?

Neutral action: Write down the exact code the agent uses for your filing; it changes the premium.

Show me the nerdy details

Carriers price territorially (ZIP), behaviorally (tickets, claims), and by limit selection. High-risk markets can have large spreads across carriers; five quotes can shift annual cost by $600–$1,800 in 2025. Named-driver exclusions, non-owner SR-22 policies, and telematics discounts are levers to check (Source, 2025-09).

State Nuance 2025 (US): No-Fault, PIP, and Small-Claims Windows

Not all states handle crashes the same. Some are no-fault (PIP pays your medical regardless of fault up to a limit), others are tort (the at-fault party pays). Many are hybrids. If you’re uninsured, this matters because it changes who pays first and how fast you must act (Source, 2025-07).

- No-fault examples: PIP first for your injuries (up to the state’s limit). Thresholds determine when you can sue.

- Tort examples: Claims flow through the at-fault party. Comparative negligence may reduce payouts by your % of fault.

- Small-claims: Filing limits and timelines vary; many courts publish a one-page guide and standard forms.

Anecdote: A driver in a no-fault state skipped PIP forms for two weeks, then learned reimbursement clocks start at service date. Two calls and one form later, checks began.

Money Block — Coverage Tier Map (If You Must Buy Now)

- Tier 1: State minimums + SR-22 — cheapest entry; protects license, not assets.

- Tier 2: 50/100/50 + MedPay — better for modest assets and daily drivers.

- Tier 3: 100/300/100 + UM/UIM — common “sleep-at-night” limits for commuters.

- Tier 4: 250/500/100 + umbrella — if you own property or have high income.

- Tier 5: Specialty + FR-44 — court-ordered high limits; budget carefully.

Neutral action: Compare coverage tiers with this year’s deductible before you pay.

- Tier up later.

- Stay paid, stay licensed.

- Ask about non-owner filings if car-free.

Apply in 60 seconds: Write your current limit target and the monthly payment you can actually make.

A Simple Documentation System That Saves You $ and Time

Think like a claims clerk. Build a tiny file that answers the next person’s question before they ask.

- Folder name: “Crash-YYYY-MM-DD.”

- Subfolders: photos, estimates, medical, messages, payments.

- One summary page: who/when/where/what/why + your plan and dates.

Anecdote: I once slid a one-page summary across a body shop counter. The manager stared, then knocked 10% off “because you’re organized.”

Short Story: The tow yard smelled like rubber and resignation. A young dad shuffled in with a diaper bag and a manila envelope. “I don’t have insurance,” he said, “but I have a plan.” Inside were photos, a police number, and two money orders totaling $600—he’d sold a guitar. The clerk blinked, then lowered her voice: “If you can pay $150 on Fridays, I’ll mark you as ‘good-faith.’” They shook hands. Three months later, he sent a photo of a cleared balance and a car seat buckled in place. The guitar? “I’ll buy another when I can.” He had bought time for his family. The odometer kept turning, but so did his luck. (120–180 words)

FAQ

Q1. I caused a minor crash and have no insurance. Do I have to call the police?

A. If anyone is injured or damage exceeds your state’s reporting threshold, yes. If not, many jurisdictions allow self-report within 24–72 hours. 60-second action: Search “police report online [your city]” and file today.

Q2. Will the other driver’s insurance pay even if I’m uninsured?

A. Their UM/UIM and MedPay/PIP could cover some losses depending on state rules. It doesn’t protect you from paying for their damages if you’re liable. 60-second action: Ask for their carrier/policy and whether MedPay/PIP applies.

Q3. How fast do I need to arrange payment to avoid collections?

A. Aim for a written plan within 7–10 days. Earlier is better. 60-second action: Draft a two-line plan with dates and attach proof of funds.

Q4. Can I buy insurance after the crash and have it cover this accident?

A. No. Policies start at inception; they don’t pay for prior losses. You can, however, purchase a policy (with SR-22/FR-44 if needed) to protect your license going forward. 60-second action: Get three quotes that include the filing if required.

Q5. I’m partly at fault. How does that change the math?

A. In comparative negligence states, your share of fault reduces what you can recover and may reduce what you owe. 60-second action: Re-run the estimator at 50–80% fault.

Q6. What if I can’t afford any payment right now?

A. Ask for a short hold (7–14 days) and propose dates tied to your next paycheck. Consider a small-claims structure with court oversight if it helps you stay on track. 60-second action: Text the proposed schedule with one proof document.

Q7. Do I need a lawyer?

A. Not always. For injuries, high totals, or contested fault, a consult is wise. Many offer free first calls. 60-second action: Book one consult; bring your photos and the incident number.

Q8. Will this affect my ability to get insurance later?

A. Yes—expect higher premiums for a period. Shopping across 5+ carriers and choosing realistic limits can cut the increase. 60-second action: Prepare the quote-prep list above and compare carriers.